Your firm is a U.K.-based exporter of British bicycles.You have sold an order to an Italian firm for €1,000,000 worth of bicycles.Payment from the Italian firm (in €) is due in twelve months.Your firm wants to hedge the receivable into pounds.Not dollars.Interest rates are 3% in €,2% in $ and 4% in £.  Detail a strategy using spot exchange rates and borrowing or lending that will hedge your exchange rate risk.

Detail a strategy using spot exchange rates and borrowing or lending that will hedge your exchange rate risk.

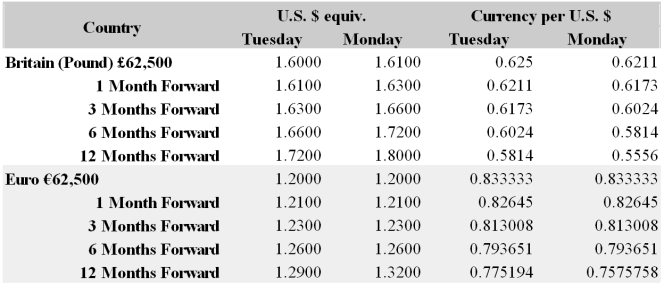

A) Borrow €970,873.79 in one year you owe €1m, which will be financed with the receivable.Convert €970,873.79 to dollars at spot, receive $1,165,048.54.Convert dollars to pounds at spot, receive £728,155.34.

B) Sell €1m forward using 16 contracts at $1.20 per €1.Buy £750,000 forward using 12 contracts at $1.60 per £1.

C) Sell €1m forward using 16 contracts at the forward rate of $1.29 per €1.Buy £750,000 forward using 12 contracts at the forward rate of $1.72 per £1.

D) None of the above

Correct Answer:

Verified

Q47: From the perspective of a corporate CFO,

Q48: A U.S. firm has sold an Italian

Q51: Your firm is a Swiss exporter of

Q51: Which of the following options strategies are

Q52: Your firm is a U.K.-based exporter of

Q53: A Japanese IMPORTER has a $1,250,000

Q54: A Japanese EXPORTER has a €1,000,000

Q57: A Japanese EXPORTER has a €1,000,000

Q59: Your firm is an Italian importer of

Q60: A Japanese IMPORTER has a €1,000,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents