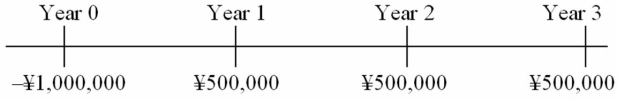

The spot exchange rate is ¥125 = $1.The U.S.discount rate is 10%; inflation over the next three years is 3% per year in the U.S.and 2% per year in Japan.Calculate the dollar NPV of this project.  I did not round my intermediate steps,if you did,select the answer closest to yours.

I did not round my intermediate steps,if you did,select the answer closest to yours.

A) $267,181.87

B) $14,176.67

C) $2,536.49

D) $2,137.46

E) None of the above

Correct Answer:

Verified

Q42: What is CF0 in dollars?

Q42: The ABC Company,a U.S.-based MNC,plans to establish

Q44: What is the expected return on equity

Q44: Which of the following statements is false

Q50: In the context of the capital budgeting

Q52: Sensitivity analysis in the calculation of the

Q53: As of today, the spot exchange rate

Q67: What is the euro-denominated IRR of this

Q71: What is the euro-denominated IRR?

Q73: What is CF5 in dollars?

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents