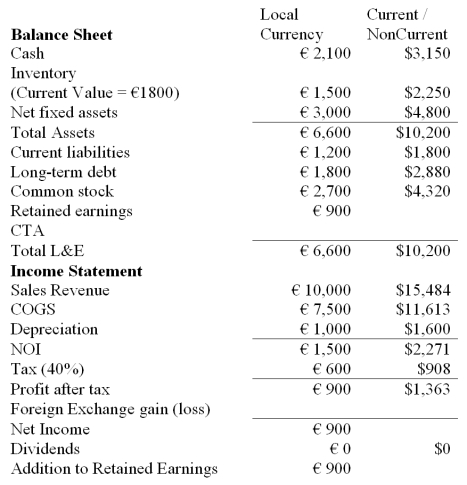

Find the foreign currency gain or loss for this U.S.MNC translating the balance sheet and income statement of a French subsidiary,which keeps its books in euro,but that is translated into U.S.dollars using the current/noncurrent method,the reporting currency of the U.S.MNC.

The subsidiary is at the end of its first year of operation.

The historical exchange rate is $1.60/€1.00 and the most recent exchange rate is $1.50/€

Correct Answer:

Verified

Q62: Translation exposure,

A)is not entity specific, rather it

Q65: A derivatives hedge that seeks to eliminate

Q68: Under which method does the gain or

Q73: Under FASB 52, when a net translation

Q73: A highly inflationary economy is defined in

Q75: In highly inflationary economies, FASB 52 requires

Q78: With regard to research on the stock

Q79: The impact of financing in determining the

Q80: Generally speaking,

A)it is not possible to hedge

Q81: Calculate the cumulative translation adjustment for this

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents