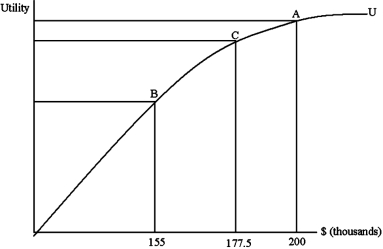

Megan is trying to decide whether to buy house insurance for her home in Miami. Her house is worth $200,000 and analysts have determined that the average loss from a Hurricane could be $45,000. They have also determined there is a 50 percent chance that she will face a hurricane. Suppose Megan is a risk averse person with a utility-of-income function such as the one given below. If the policy costs $22,500, Megan will

A) buy the insurance.

B) not buy the insurance.

C) be indifferent between buying or not buying the insurance.

D) we can't say.

Correct Answer:

Verified

Q31: Eleanor and her father have identical driving

Q32: When a trading opportunity is presented to

Q33: (Appendix) If the cost of search is

Q34: For a large group of individuals, the

Q35: The Affordable Care Act (Obama Care) requires

Q37: Faced with the gamble: heads you win

Q38: Your utility function is given by U

Q39: When Jeff bought a house he also

Q40: If the slope of a person's utility

Q41: Your bike is worth $100 and if

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents