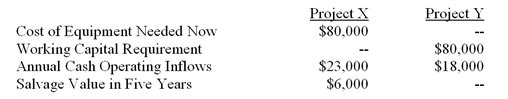

The Sawyer Company has $80,000 to invest and is considering two different projects: X and Y. The following data are available on the projects:

Both projects will have a useful life of five years; at the end of five years, the working capital will be released for use elsewhere. Sawyer's discount rate is 12%. (Ignore income taxes in this problem.)

-What is the net present value of project X?

A) ($11,708) .

B) $2,915.

C) $5,283.

D) $6,317.

Correct Answer:

Verified

Q90: Q95: Q95: Bugle's Bagel Bakery is investigating the purchase Q96: The Becker Company is interested in buying Q98: The Finney Company is reviewing the possibility Q102: The Becker Company is interested in buying Q103: Westland College has a telephone system that Q105: UR Company is considering rebuilding and selling Q109: Purvell Company has just acquired a Q120: Fast Food, Inc. has purchased a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents