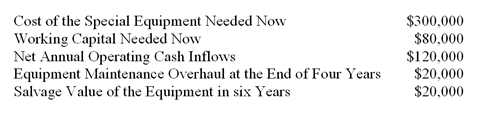

The Morgan Company has been awarded a six-year contract to provide repair service to a commercial bus line. Morgan Company has gathered the following data associated with the items needed for this contract:

The special equipment is in Class 7 with a maximum 15% CCA rate. The income tax rate is 40%, and Morgan's after-tax cost of capital is 14%. At the end of six years, the working capital will be released for use elsewhere.

-The present value of the after-tax cash from the sale of the equipment at the end of six years is closest to which of the following?

A) $0.

B) $3,645.

C) $5,467.

D) $9,112.

Correct Answer:

Verified

Q118: Lambert Manufacturing has $60,000 to invest in

Q119: Payson Company bought $40,000 worth of office

Q120: Lambert Manufacturing has $60,000 to invest in

Q121: Eureka Company is considering replacing an old

Q122: Layton Company is replacing an old delivery

Q124: The Morgan Company has been awarded a

Q125: A piece of equipment, acquired in Year

Q125: Layton Company is replacing an old

Q127: Layton Company is replacing an old delivery

Q128: A piece of equipment, acquired in Year

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents