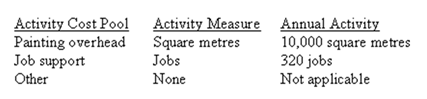

Jackson Painting paints the interiors and exteriors of homes and commercial buildings.The company uses an activity-based costing system for its overhead costs.The company has provided the following data concerning its activity-based costing system.

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.

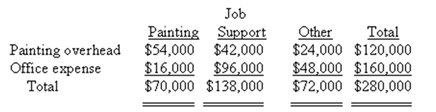

The company has already finished the first stage of the allocation process in which costs were allocated to the activity cost centres. The results are listed below:

Required:

a) Compute the activity rates (i.e., cost per unit of activity) for the Painting and Job Support activity cost pools by filling in the table below. Round off all calculations to the nearest whole cent.

b) (Appendix 5A) Prepare an action analysis report in good form of a job that involves painting 63 square metres and has direct materials and direct labour cost of $2,070. The sales revenue from this job is $2,500. For purposes of this action analysis report, direct materials and direct labour should be classified as a Green cost, painting overhead as a Red cost, and office expense as a Yellow cost.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q19: In general, duration drivers are more accurate

Q102: Cabanos Company manufactures two products,Product C and

Q104: (Appendix 5A)An action analysis report reconciles activity-based

Q106: Goel Company,a wholesale distributor,uses activity-based costing for

Q108: Ingersol Draperies makes custom draperies for homes

Q109: Hasty Hardwood Floors installs oak and other

Q110: Phoenix Company makes custom covers for air

Q111: Managing and sustaining product diversity requires many

Q111: Daba Company manufactures two products,Product F and

Q121: Activity-based-costing (ABC)charges products for the cost of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents