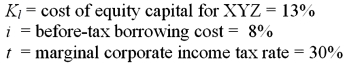

Assume that XYZ Corporation is a leveraged company with the following information:  Calculate the debt-to-total-market-value ratio that would result in XYZ having a weighted average cost of capital of 9.3%.

Calculate the debt-to-total-market-value ratio that would result in XYZ having a weighted average cost of capital of 9.3%.

A) 35%

B) 40%

C) 45%

D) 50%

Correct Answer:

Verified

Q42: The ABC Company,a U.S.-based MNC,plans to establish

Q53: As of today, the spot exchange rate

Q54: As of today, the spot exchange rate

Q55: Today is January 1, 2009. The state

Q56: The spot exchange rate is ¥125 =

Q57: What is CF1 in dollars?

Q60: An Italian firm is considering selling its

Q61: What is the dollar-denominated IRR?

Q62: Find the break-even price (in dollars) and

Q78: Find the euro-zone cost of capital to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents