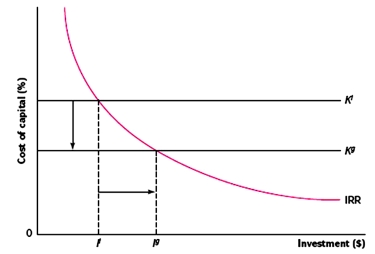

In the graph,

A) Kl and Kg represent, respectively, the cost of capital under international and local capital structures; IRR represents the internal rate of return on investment projects; Il and Ig represent, respectively, the optimal investment outlays under the alternative capital structures.

B) Kl and Kg represent, respectively, the cost of capital under local and international capital structures; IRR represents the internal rate of return on investment projects; Il and Ig represent the optimal investment outlays under the alternative capital structures.

C) None of the above

Correct Answer:

Verified

Q29: The required return on equity for a

Q74: In the Capital Asset Pricing Model (CAPM),

Q75: The firm's tax rate is 34%. The

Q75: The following is an outline of certain

Q76: Assume that XYZ Corporation is a levered

Q76: The following is an outline of certain

Q77: Assume that XYZ Corporation is a leveraged

Q80: Recent studies suggest that agency costs of

Q81: A firm may cross-list its share to

A)establish

Q88: Companies domiciled in countries with weak investor

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents