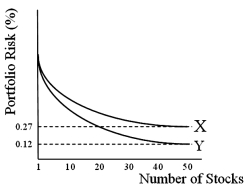

In the graph at right, X and Y represent

A) U.S. stocks and international stocks.

B) international stocks and U.S. stocks.

C) systematic risk and unsystematic risk.

D) none of the above

Correct Answer:

Verified

Q6: The "world beta" measures the

A)unsystematic risk.

B)sensitivity of

Q10: In the context of investments in securities

Q11: A fully diversified U.S. portfolio is about

A)75

Q12: The "Sharpe performance measure" (SHP) is

A)a "risk-adjusted"

Q15: Regarding the mechanics of international portfolio diversification,

Q16: You will get more diversification

A)across industries than

Q17: With regard to the OIP,

A)the optimal international

Q18: The "Sharpe performance measure" (SHP) is

A)

Q19: Systematic risk

A)is also known as non-diversifiable risk.

B)is

Q20: The less correlated the securities in a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents