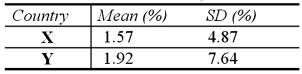

The mean and standard deviation (SD) of monthly returns, over a given period of time, for the stock markets of two countries, X and Y are  Assuming that the monthly risk-free interest rate is 0.25%, the Sharpe performance measures, SHP(X) and SHP(Y) , and the performance ranks, respectively, for X and Y are:

Assuming that the monthly risk-free interest rate is 0.25%, the Sharpe performance measures, SHP(X) and SHP(Y) , and the performance ranks, respectively, for X and Y are:

A) SHP(X) = 0.271, rank = 1, and SHP(Y) = 0.219, rank = 2

B) SHP(X) = 0.271, rank = 2, and SHP(Y) = 0.219, rank = 1

C) SHP(X) = 18.84, rank = 1, and SHP(Y) = 23.04, rank = 2

D) SHP(X) = 23.04, rank = 2, and SHP(Y) = 18.84, rank = 1

Correct Answer:

Verified

Q3: With regard to the OIP,

A)the composition of

Q4: With regard to the OIP,

A)the composition of

Q5: Foreign equities as a proportion of U.S.

Q6: With regard to the OIP,

A)the composition of

Q6: The "world beta" measures the

A)unsystematic risk.

B)sensitivity of

Q7: Under the investment dollar premium system,

A)U.K. residents

Q10: In the context of investments in securities

Q11: A fully diversified U.S. portfolio is about

A)75

Q12: The "Sharpe performance measure" (SHP) is

A)a "risk-adjusted"

Q20: The less correlated the securities in a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents