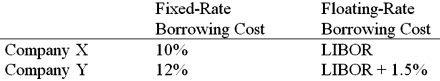

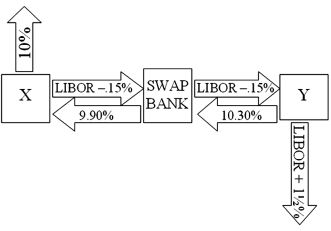

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow $10,000,000 fixed for 5 years. Their external borrowing opportunities are shown below:  A swap bank proposes the following interest only swap: X will pay the swap bank annual payments on $10,000,000 with the coupon rate of LIBOR - 0.15%; in exchange the swap bank will pay to company X interest payments on $10,000,000 at a fixed rate of 9.90%. Y will pay the swap bank interest payments on $10,000,000 at a fixed rate of 10.30% and the swap bank will pay Y annual payments on $10,000,000 with the coupon rate of LIBOR - 0.15%.

A swap bank proposes the following interest only swap: X will pay the swap bank annual payments on $10,000,000 with the coupon rate of LIBOR - 0.15%; in exchange the swap bank will pay to company X interest payments on $10,000,000 at a fixed rate of 9.90%. Y will pay the swap bank interest payments on $10,000,000 at a fixed rate of 10.30% and the swap bank will pay Y annual payments on $10,000,000 with the coupon rate of LIBOR - 0.15%.  What is the value of this swap to the swap bank?

What is the value of this swap to the swap bank?

A) The swap bank will lose money on the deal.

B) The swap bank will earn 40 basis points per year on $10,000,000 = $40,000 per year.

C) The swap bank will break even.

D) None of the above

Correct Answer:

Verified

Q1: The primary reasons for a counterparty to

Q2: Suppose the quote for a five-year swap

Q3: The term interest rate swap

A)refers to a

Q4: A swap bank makes the following quotes

Q5: A swap bank

A)can act as a broker,

Q7: A swap bank has identified two companies

Q8: Examples of "single-currency interest rate swap" and

Q9: An interest-only single currency interest rate swap

A)is

Q10: Company X wants to borrow $10,000,000 floating

Q11: Suppose the quote for a five-year swap

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents