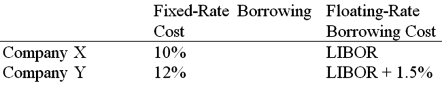

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow $10,000,000 fixed for 5 years. Their external borrowing opportunities are shown below:  A swap bank is involved and quotes the following rates five-year dollar interest rate swaps at 10.05%-10.45% against LIBOR flat.

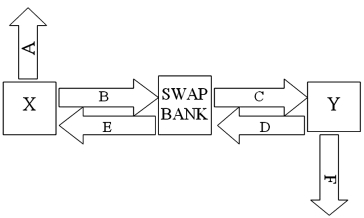

A swap bank is involved and quotes the following rates five-year dollar interest rate swaps at 10.05%-10.45% against LIBOR flat.  Assume both X and Y agree to the swap bank's terms. Fill in the values for A, B, C, D, E, & F on the diagram.

Assume both X and Y agree to the swap bank's terms. Fill in the values for A, B, C, D, E, & F on the diagram.

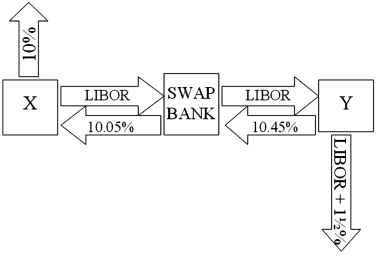

A) A = LIBOR; B = 10.45%; C = 10.05%; D = LIBOR; E = LIBOR; F = 12%

B) A = 10%; B = 10.45%; C = 10.05%; D = LIBOR; E = LIBOR; F = LIBOR + 1½%

C) A = 10%; B = 10.45%; C = LIBOR; D = LIBOR; E = 10.05%; F = LIBOR + 1½%

D) A = 10%; B = LIBOR; C = LIBOR; D = 10.45%; E = 10.05%; F = LIBOR + 1½%

Correct Answer:

Verified

Q8: Examples of "single-currency interest rate swap" and

Q9: An interest-only single currency interest rate swap

A)is

Q10: Company X wants to borrow $10,000,000 floating

Q11: Suppose the quote for a five-year swap

Q12: A swap bank has identified two companies

Q14: Company X wants to borrow $10,000,000 floating

Q15: Company X wants to borrow $10,000,000 floating

Q16: In the swap market, which position potentially

Q17: The size of the swap market is

A)measured

Q18: Suppose the quote for a five-year swap

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents