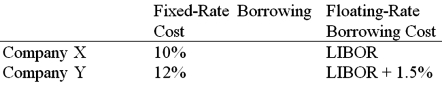

Use the following information to calculate the quality spread differential (QSD) :

A) 0.50%

B) 1.00%

C) 1.50%

D) 2.00%

Correct Answer:

Verified

Q35: Suppose ABC Investment Banker Ltd., is quoting

Q36: Company X wants to borrow $10,000,000 for

Q37: Floating for floating currency swaps

A)the reference rates

Q38: Company X wants to borrow $10,000,000 floating

Q39: Pricing a currency swap after inception involves

A)finding

Q41: A major that can be eliminated through

Q41: Nominal differences in currency swaps

A)can be explained

Q42: Floating for floating currency swaps

A)the reference rates

Q43: Consider a plain vanilla interest rate swap.

Q45: Consider fixed-for-fixed currency swap. Firm A is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents