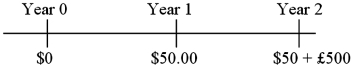

Find the value today of a 2-year dual currency bond with annual coupons (paid in U.S. dollars at a 5 percent coupon rate) that pays £500 per $1,000 par value at maturity. The cash flows of the bond are:  The dollar-based yield to maturity is i$ = 3%; the spot exchange rate is $1.80 = £1.00; expected inflation over the next three years is π$ = 2% in the U.S. and π£ = 3% in the U.K.

The dollar-based yield to maturity is i$ = 3%; the spot exchange rate is $1.80 = £1.00; expected inflation over the next three years is π$ = 2% in the U.S. and π£ = 3% in the U.K.

A) $927.62

B) $941.30

C) $965.06

D) $599.00

Correct Answer:

Verified

Q73: "Investment grade" ratings are in the following

Q74: Find the value of a three-year dual

Q75: Zero coupon bonds

A)have no interest income.

B)are sold

Q76: U.S. citizens must pay tax on the

Q77: A 1-year, 4 percent euro denominated bond

Q79: With regard to dual-currency bonds versus comparable

Q80: Zero coupon bonds

A)pay interest at zero percent.

B)are

Q81: The secondary market for Eurobonds

A)is an over-the-counter

Q83: A bond market index

A)is a reference rate,

Q97: Underwriters for an international bond issue will

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents