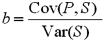

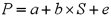

The exposure coefficient  in the regression

in the regression  is:

is:

A) A measure of how a change in the exchange rate affects the dollar value of a firm's assets.

B) Has a value of zero if the value of the firm's assets is perfectly correlated with changes in the exchange rate.

C) both a and b

D) none of the above

Correct Answer:

Verified

Q1: When exchange rates change,

A)this can alter the

Q2: The link between the home currency value

Q3: Currency risk

A)is the same as currency exposure.

B)represents

Q4: When the Mexican peso collapsed in 1994,

Q7: The link between a firm's future operating

Q8: When exchange rates change,

A)U.S. firms that produce

Q9: Suppose a U.S.-based MNC maintains a vacation

Q10: The exposure coefficient in the regression

Q11: Exposure to currency risk can be measured

Q13: Economic exposure refers to

A)the sensitivity of realized

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents