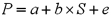

From the perspective of the U.S. firm that owns an asset in Britain, the exposure that can be measured by the coefficient b in regressing the dollar value P of the British asset on the dollar/pound exchange rate S using the regression equation  is

is

A) asset exposure.

B) operating exposure.

C) accounting exposure.

D) none of the above

Correct Answer:

Verified

Q23: The variability of the dollar value of

Q24: Which of the following would be an

Q25: On the basis of regression Equation

Q26: A U.S. firm holds an asset in

Q26: A firm with a highly elastic demand

Q27: On the basis of regression Equation

Q29: With regard to operational hedging versus financial

Q30: A U.S. firm holds an asset in

Q30: A U.S. firm holds an asset in

Q32: The extent to which the firm's operating

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents