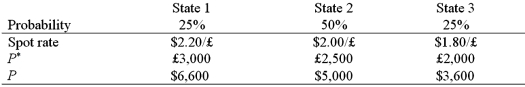

A U.S. firm holds an asset in Great Britain and faces the following scenario:  where,

where,

P* = Pound sterling price of the asset held by the U.S. firm

P = Dollar price of the same asset

-The expected value of the investment in U.S. dollars is:

A) $5,050

B) $3,700

C) $2,112.50

D) none of the above

Correct Answer:

Verified

Q19: What does it mean to have redenominated

Q26: A firm with a highly elastic demand

Q30: A U.S. firm holds an asset in

Q30: A U.S. firm holds an asset in

Q32: The extent to which the firm's operating

Q34: In recent years,

A)the U.S. dollar has appreciated

Q34: Operating exposure can be defined as

A)the link

Q36: Which of the following are identified by

Q38: On the basis of regression Equation

Q40: The "exposure" (i.e. the regression coefficient beta)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents