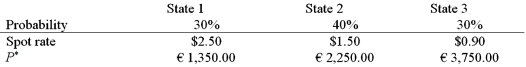

A U.S. firm holds an asset in Italy and faces the following scenario:  Where P* = Euro price of the asset held by the U.S. firm

Where P* = Euro price of the asset held by the U.S. firm

The CFO decides to hedge his exposure by selling forward the expected value of the euro denominated cash flow at F1($/£) = $1.50/€. As a result

A) the firm's exposure to the exchange rate is made worse.

B) he has a nearly perfect hedge.

C) he has a perfect hedge.

D) none of the above

Correct Answer:

Verified

Q45: A U.S. firm holds an asset in

Q46: Which of the following would be an

Q47: Suppose a U.S. firm has an asset

Q48: The "exposure" (i.e. the regression coefficient beta)

Q49: Which of the following conclusions are correct?

A)Most

Q51: Which of the following would be an

Q52: The "exposure" (i.e. the regression coefficient beta)

Q53: Find an effective hedge financial hedge if

Q54: Which of the following conclusions are correct?

A)Most

Q55: Which of the following conclusions are correct?

A)Most

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents