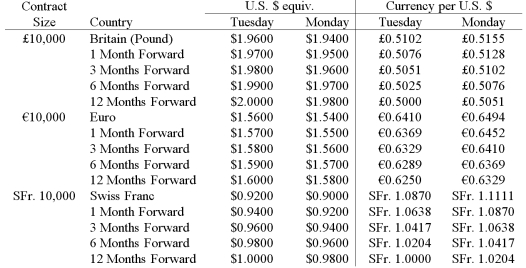

Your firm is a U.K.-based exporter of bicycles. You have sold an order to a French firm for €1,000,000 worth of bicycles. Payment from the French firm (in euro) is due in 12 months. Detail a strategy using futures contracts that will hedge your exchange rate risk. Have an estimate of how many contracts of what type and maturity.

A) Go short 100 12-month euro futures contracts; and short 80 12-month pound futures contracts.

B) Go long 100 12-month euro futures contracts; and long 80 12-month pound futures contracts.

C) Go long 100 12-month euro futures contracts; and short 80 12-month pound futures contracts.

D) Go short 100 12-month euro futures contracts; and long 80 12-month pound futures contracts.

E) None of the above

Correct Answer:

Verified

Q10: The sensitivity of the firm's consolidated financial

Q20: The choice between a forward market hedge

Q21: Your firm is an Italian exporter of

Q22: Your firm is a U.K.-based exporter of

Q23: Your firm is a U.K.-based importer of

Q25: Your firm is an Italian importer of

Q26: Your firm is a Swiss exporter of

Q27: Your firm is an Italian importer of

Q28: Your firm has a British customer that

Q29: Your firm is a Swiss importer of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents