Your firm is a Swiss exporter of bicycles. You have sold an order to a British firm for £1,000,000 worth of bicycles. Payment from the British firm (in pounds sterling) is due in 12 months. Detail a strategy using futures contracts that will hedge your exchange rate risk. Have an estimate of how many contracts of what type and maturity.

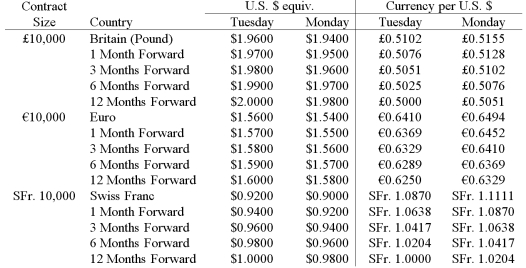

A) Go short 100 12-month pound futures contracts; and long 200 12-month SFr. futures contracts.

B) Go long 100 12-month pound futures contracts; and short 200 12-month SFr. futures contracts.

C) Go short 100 12-month pound futures contracts; and short 200 12-month SFr. futures contracts.

D) Go long 100 12-month pound futures contracts; and long 200 12-month SFr. futures contracts.

E) None of the above

Correct Answer:

Verified

Q32: Your firm is a U.K.-based exporter of

Q33: Your firm is a Swiss importer of

Q34: Your firm is an Italian exporter of

Q35: Your firm is a U.S.-based exporter of

Q36: Your firm is a U.K.-based exporter of

Q38: Your firm is a U.K.-based importer of

Q39: Your firm is an Italian exporter of

Q40: Your firm is a Swiss exporter of

Q41: A Japanese IMPORTER has a €1,000,000 PAYABLE

Q42: A Japanese EXPORTER has a €1,000,000 receivable

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents