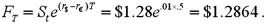

Assume that the dollar-euro spot rate is $1.28 and the six-month forward rate is  The six-month U.S. dollar rate is 5% and the Eurodollar rate is 4%. The minimum price that a six-month American call option with a striking price of $1.25 should sell for in a rational market is

The six-month U.S. dollar rate is 5% and the Eurodollar rate is 4%. The minimum price that a six-month American call option with a striking price of $1.25 should sell for in a rational market is

A) 0 cents.

B) 3.47 cents.

C) 3.55 cents.

D) 3 cents.

Correct Answer:

Verified

Q45: For European currency options written on euro

Q46: Find the hedge ratio for a call

Q47: For European currency options written on euro

Q48: Find the value of a call option

Q50: For European currency options written on euro

Q51: Which of the following is correct?

A)European options

Q52: American call and put premiums

A)should be at

Q53: Find the hedge ratio for a put

Q54: For European options, what of the effect

Q55: For European currency options written on euro

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents