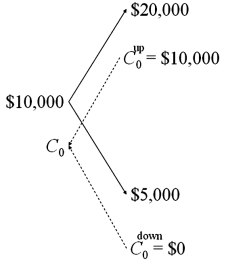

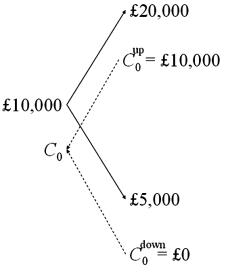

Draw the tree for a call option on $20,000 with a strike price of £10,000. The current exchange rate is £1.00 = $2.00 and in one period the dollar value of the pound will either double or be cut in half. The current interest rates are i$ = 3% and are i£ = 2%.

A)

B)

C) None of the above

Correct Answer:

Verified

Q53: Find the hedge ratio for a put

Q53: Use the binomial option pricing model to

Q54: For European options, what of the effect

Q55: For European currency options written on euro

Q56: You have written a call option on

Q57: For European options, what of the effect

Q59: For an American call option, A and

Q61: Empirical tests of the Black-Scholes option pricing

Q62: Find the input d1 of the Black-Scholes

Q63: Empirical tests of the Black-Scholes option pricing

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents