Value a 1-year call option written on £10,000 with an exercise price of $2.00 = £1.00. The spot exchange rate is $2.00 = £1.00; The U.S. risk-free rate is 5% and the U.K. risk-free rate is also 5%. In the next year, the pound will either double in dollar terms or fall by half (i.e. u = 2 and d = ½) . Hint: H = ⅔.

A) $6,349.21

B)

C)

D) None of the above

Correct Answer:

Verified

Q68: Calculate the current €/£ spot exchange rate.

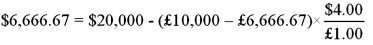

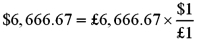

Q74: Find the dollar value today of a

Q75: Verify that the dollar value of your

Q76: Find the risk-neutral probability of an "up"

Q77: Find the value of a one-year call

Q78: The Black-Scholes option pricing formulae

A)are used widely

Q80: The same call from the last question

Q81: State the composition of the replicating portfolio;

Q82: Draw the tree.

Q84: Use your results from the last three

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents