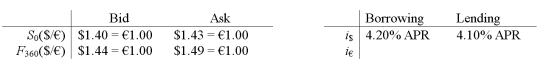

How high does the lending rate in the euro zone have to be before an arbitrageur would NOT consider borrowing dollars, trading for euro at the spot, investing in the euro zone and hedging with a short position in the forward contract?

A) The bid-ask spreads are too wide for any profitable arbitrage when i€ > 0

B) 3.48%

C) -2.09%

D) None of the above

Correct Answer:

Verified

Q1: A currency dealer has good credit and

Q2: Interest Rate Parity (IRP) is best defined

Q3: Suppose you observe a spot exchange rate

Q4: A U.S.-based currency dealer has good credit

Q5: An arbitrage is best defined as

A)a legal

Q7: Suppose you observe a spot exchange rate

Q8: Suppose that the one-year interest rate is

Q9: Suppose you observe a spot exchange rate

Q10: Covered Interest Arbitrage (CIA) activities will result

Q11: Suppose that the one-year interest rate is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents