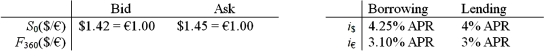

Consider a bank dealer who faces the following spot rates and interest rates. What should he set his 1-year forward bid price at?

A) $1.4324/€

B) $1.4358/€

C) $1.4662/€

D) $1.4676/€

Correct Answer:

Verified

Q8: Suppose that the annual interest rate is

Q19: Suppose that you are the treasurer of

Q20: When Interest Rate Parity (IRP) does not

Q21: Consider a bank dealer who faces the

Q24: If the interest rate in the U.S.

Q25: If the annual inflation rate is 2.5

Q25: A currency dealer has good credit and

Q26: Suppose that the one-year interest rate is

Q27: As of today, the spot exchange rate

Q28: Although IRP tends to hold, it may

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents