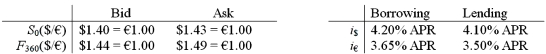

Will an arbitrageur facing the following prices be able to make money?

A) Yes, borrow €1,000,000 at 3.65%; Trade for $ at the bid spot rate $1.40 = €1.00; Invest at 4.1%; Hedge this with a long position in a forward contract.

B) Yes, borrow $1,000,000 at 4.2%; Trade for € at the spot ask exchange rate $1.43 = €1.00; Invest €699,300.70 at 3.5%; Hedge this by going SHORT in forward (agree to sell € @ BID price of $1.44/€ in one year) . Cash flow in 1 year $237.76.

C) No; the transactions costs are too high.

D) None of the above

Correct Answer:

Verified

Q31: As of today, the spot exchange rate

Q32: The price of a McDonald's Big Mac

Q33: In view of the fact that PPP

Q34: Will an arbitrageur facing the following prices

Q35: Some commodities never enter into international trade.

Q37: Generally unfavorable evidence on PPP suggests that

A)substantial

Q38: If a foreign county experiences a hyperinflation,

A)its

Q39: If IRP fails to hold

A)pressure from arbitrageurs

Q40: A higher U.S. interest rate (i$ ↑)

Q41: The Efficient Markets Hypothesis states

A)markets tend to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents