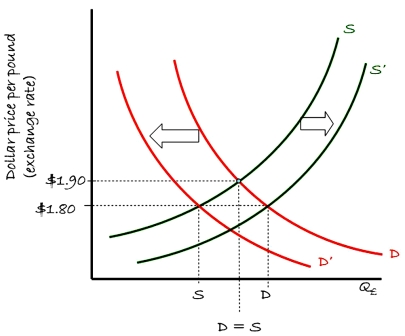

Consider the supply-demand framework for the British pound relative to the U.S. dollar shown in the nearby chart. The exchange rate is currently $1.80 = £1.00. Which of the following is correct?

A) To "fix" the exchange rate at $1.80 = £1.00, the Federal Reserve could use contractionary monetary policy to shift the demand curve to the left.

B) To "fix" the exchange rate at $1.80 = £1.00, the U.S. government could use contractionary fiscal policy to shift the demand curve to the left.

C) The British Government could use fiscal or monetary policy to shift the supply curve to the right to fix the exchange rate to $1.80 = £1.00.

D) All of the above.

Correct Answer:

Verified

Q90: Prior to the peso crisis, Mexico depended

Q91: A booming economy with a fixed or

Q91: Another name for the incompatible trinity is

Q92: Advantages of a flexible exchange rates include

Q94: Advantages of a fixed exchange rates include

A)reduction

Q96: Which factors are related to the collapse

Q97: A "good" (or ideal) international monetary system

Q98: Generally speaking, liberalization of financial markets when

Q99: Once capital markets are integrated, it is

Q100: According to the "Trilemma" a country can

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents