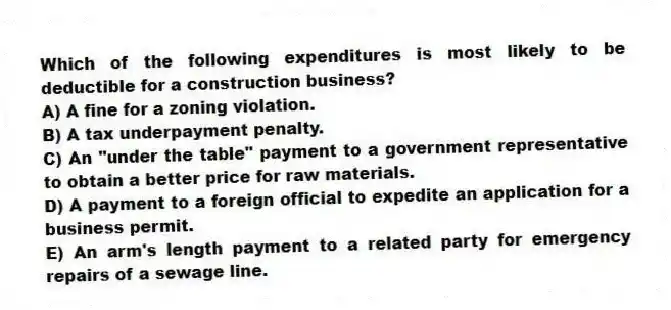

Which of the following expenditures is most likely to be deductible for a construction business?

A) A fine for a zoning violation.

B) A tax underpayment penalty.

C) An "under the table" payment to a government representative to obtain a better price for raw materials.

D) A payment to a foreign official to expedite an application for a business permit.

E) An arm's length payment to a related party for emergency repairs of a sewage line.

Correct Answer:

Verified

Q30: The 12-month rule allows taxpayers to deduct

Q31: Uniform capitalization of indirect inventory costs is

Q35: Which of the following is an explanation

Q36: Dick pays insurance premiums for his employees.

Q37: Which of the following is a True

Q42: Bill operates a proprietorship using the cash

Q43: Which of the following is a True

Q44: Clyde operates a sole proprietorship using the

Q45: Shelley is employed in Texas and recently

Q72: Beth operates a plumbing firm. In August

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents