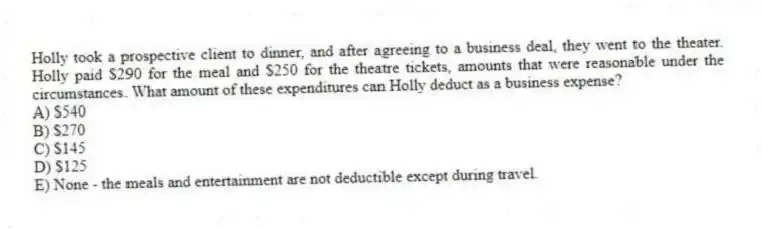

Holly took a prospective client to dinner, and after agreeing to a business deal, they went to the theater. Holly paid $290 for the meal and $250 for the theatre tickets, amounts that were reasonable under the circumstances. What amount of these expenditures can Holly deduct as a business expense?

A) $540

B) $270

C) $145

D) $125

E) None - the meals and entertainment are not deductible except during travel.

Correct Answer:

Verified

Q21: Individual proprietors report their business income and

Q23: The IRS would most likely apply the

Q24: The full-inclusion method requires cash-basis taxpayers to

Q28: Even a cash-method taxpayer must consistently use

Q30: Which of the following is a True

Q31: Paris operates a talent agency as a

Q32: The all-events test for income determines the

Q34: Which of the following is likely to

Q36: Which of the following business expense deductions

Q39: In order to deduct a portion of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents