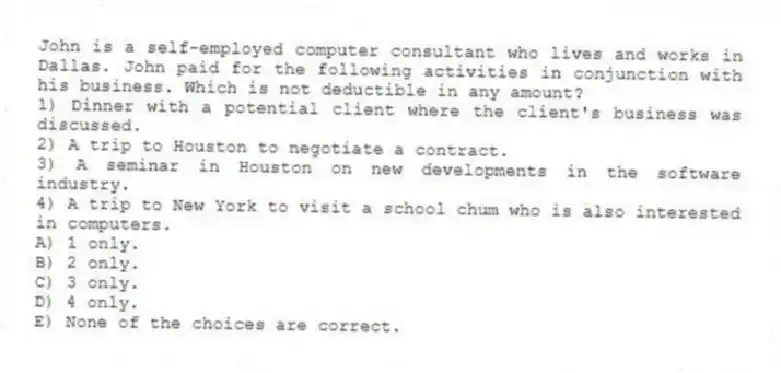

John is a self-employed computer consultant who lives and works in Dallas. John paid for the following activities in conjunction with his business. Which is not deductible in any amount?

1) Dinner with a potential client where the client's business was discussed.

2) A trip to Houston to negotiate a contract.

3) A seminar in Houston on new developments in the software industry.

4) A trip to New York to visit a school chum who is also interested in computers.

A) 1 only.

B) 2 only.

C) 3 only.

D) 4 only.

E) None of the choices are correct.

Correct Answer:

Verified

Q46: Ed is a self-employed heart surgeon who

Q50: Ronald is a cash method taxpayer who

Q51: George operates a business that generated revenues

Q52: Which of the following types of transactions

Q52: Don operates a taxi business, and this

Q56: Riley operates a plumbing business and this

Q57: Which of the following cannot be selected

Q59: Which of the following expenses are completely

Q60: Adjusted taxable income is defined as follows

Q74: Jim operates his business on the accrual

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents