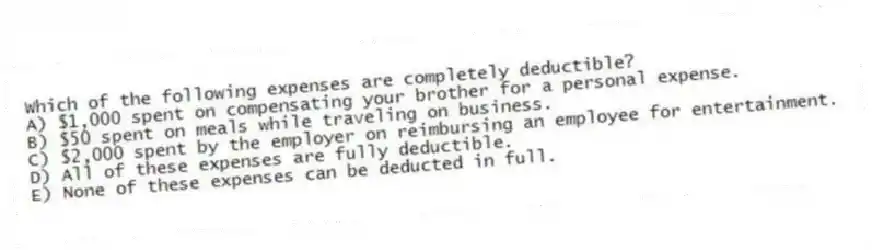

Which of the following expenses are completely deductible?

A) $1,000 spent on compensating your brother for a personal expense.

B) $50 spent on meals while traveling on business.

C) $2,000 spent by the employer on reimbursing an employee for entertainment.

D) All of these expenses are fully deductible.

E) None of these expenses can be deducted in full.

Correct Answer:

Verified

Q52: Don operates a taxi business, and this

Q55: John is a self-employed computer consultant who

Q56: Riley operates a plumbing business and this

Q57: Which of the following cannot be selected

Q60: Adjusted taxable income is defined as follows

Q61: Which of the following is a True

Q64: Brad operates a storage business on the

Q74: Jim operates his business on the accrual

Q81: Judy is a self-employed musician who performs

Q83: Manley operates a law practice on the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents