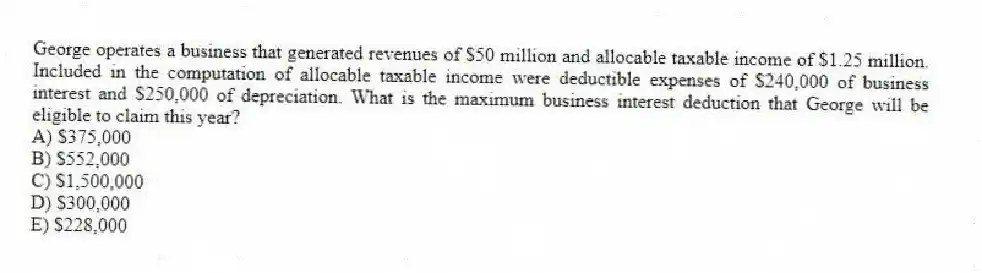

George operates a business that generated revenues of $50 million and allocable taxable income of $1.25 million. Included in the computation of allocable taxable income were deductible expenses of $240,000 of business interest and $250,000 of depreciation. What is the maximum business interest deduction that George will be eligible to claim this year?

A) $375,000

B) $552,000

C) $1,500,000

D) $300,000

E) $228,000

Correct Answer:

Verified

Q46: When does the all-events test under the

Q46: Ed is a self-employed heart surgeon who

Q47: Which of the following is a True

Q48: Colbert operates a catering service on the

Q49: Which of the following is a True

Q50: Ronald is a cash method taxpayer who

Q52: Which of the following types of transactions

Q55: John is a self-employed computer consultant who

Q56: Riley operates a plumbing business and this

Q74: Jim operates his business on the accrual

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents