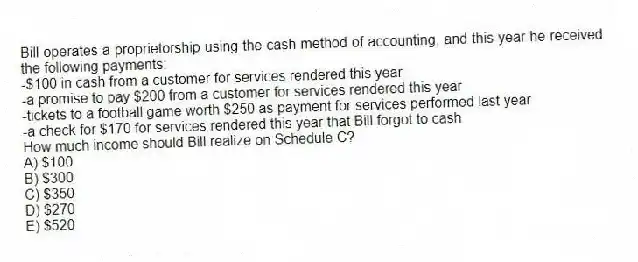

Bill operates a proprietorship using the cash method of accounting, and this year he received the following payments:

-$100 in cash from a customer for services rendered this year

-a promise to pay $200 from a customer for services rendered this year

-tickets to a football game worth $250 as payment for services performed last year

-a check for $170 for services rendered this year that Bill forgot to cash

How much income should Bill realize on Schedule C?

A) $100

B) $300

C) $350

D) $270

E) $520

Correct Answer:

Verified

Q30: The 12-month rule allows taxpayers to deduct

Q35: Which of the following is an explanation

Q37: Which of the following is a True

Q40: Which of the following expenditures is most

Q43: Which of the following is a True

Q44: Clyde operates a sole proprietorship using the

Q45: Shelley is employed in Texas and recently

Q46: When does the all-events test under the

Q47: Which of the following is a True

Q72: Beth operates a plumbing firm. In August

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents