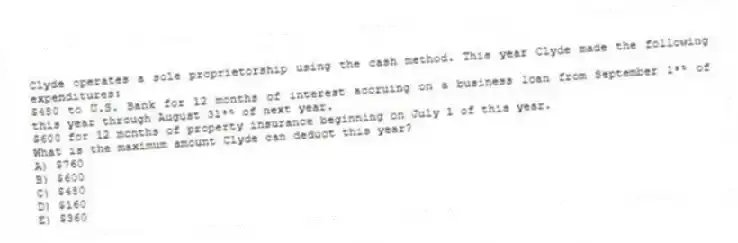

Clyde operates a sole proprietorship using the cash method. This year Clyde made the following expenditures:

$480 to U.S. Bank for 12 months of interest accruing on a business loan from September 1ˢᵗ of this year through August 31ˢᵗ of next year.

$600 for 12 months of property insurance beginning on July 1 of this year.

What is the maximum amount Clyde can deduct this year?

A) $760

B) $600

C) $480

D) $160

E) $360

Correct Answer:

Verified

Q30: The 12-month rule allows taxpayers to deduct

Q40: Which of the following expenditures is most

Q42: Bill operates a proprietorship using the cash

Q43: Which of the following is a True

Q45: Shelley is employed in Texas and recently

Q46: When does the all-events test under the

Q47: Which of the following is a True

Q48: Colbert operates a catering service on the

Q49: Which of the following is a True

Q72: Beth operates a plumbing firm. In August

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents