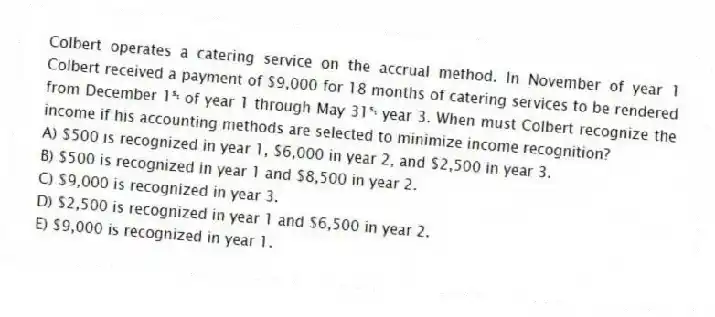

Colbert operates a catering service on the accrual method. In November of year 1 Colbert received a payment of $9,000 for 18 months of catering services to be rendered from December 1ˢᵗ of year 1 through May 31ˢᵗ year 3. When must Colbert recognize the income if his accounting methods are selected to minimize income recognition?

A) $500 is recognized in year 1, $6,000 in year 2, and $2,500 in year 3.

B) $500 is recognized in year 1 and $8,500 in year 2.

C) $9,000 is recognized in year 3.

D) $2,500 is recognized in year 1 and $6,500 in year 2.

E) $9,000 is recognized in year 1.

Correct Answer:

Verified

Q43: Which of the following is a True

Q44: Clyde operates a sole proprietorship using the

Q45: Shelley is employed in Texas and recently

Q46: When does the all-events test under the

Q46: Ed is a self-employed heart surgeon who

Q47: Which of the following is a True

Q49: Which of the following is a True

Q50: Ronald is a cash method taxpayer who

Q51: George operates a business that generated revenues

Q52: Which of the following types of transactions

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents