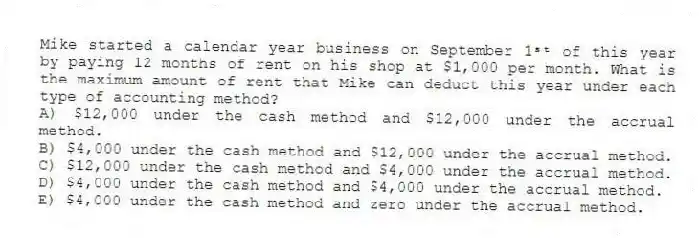

Mike started a calendar year business on September 1ˢᵗ of this year by paying 12 months of rent on his shop at $1,000 per month. What is the maximum amount of rent that Mike can deduct this year under each type of accounting method?

A) $12,000 under the cash method and $12,000 under the accrual method.

B) $4,000 under the cash method and $12,000 under the accrual method.

C) $12,000 under the cash method and $4,000 under the accrual method.

D) $4,000 under the cash method and $4,000 under the accrual method.

E) $4,000 under the cash method and zero under the accrual method.

Correct Answer:

Verified

Q65: Kip started a wholesale store this year

Q70: Joe is a self-employed electrician who operates

Q71: Smith operates a roof repair business. This

Q76: Which of the following is a True

Q78: Which of the following types of expenditures

Q78: Jones operates an upscale restaurant and he

Q79: Crystal operates a business that provides typing

Q80: Which of the following is a payment

Q80: Big Homes Corporation is an accrual method

Q98: Which of the following is NOT considered

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents