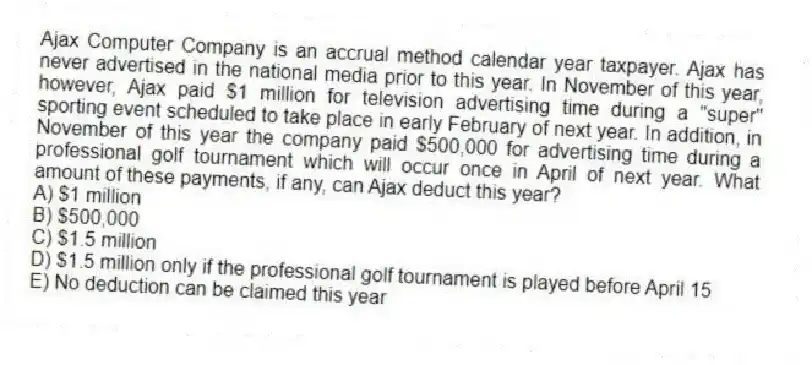

Ajax Computer Company is an accrual method calendar year taxpayer. Ajax has never advertised in the national media prior to this year. In November of this year, however, Ajax paid $1 million for television advertising time during a "super" sporting event scheduled to take place in early February of next year. In addition, in November of this year the company paid $500,000 for advertising time during a professional golf tournament which will occur once in April of next year. What amount of these payments, if any, can Ajax deduct this year?

A) $1 million

B) $500,000

C) $1.5 million

D) $1.5 million only if the professional golf tournament is played before April 15

E) No deduction can be claimed this year

Correct Answer:

Verified

Q61: Which of the following is a True

Q64: Brad operates a storage business on the

Q65: Which of the following is a True

Q67: Werner is the president and CEO of

Q70: Joe is a self-employed electrician who operates

Q71: Smith operates a roof repair business. This

Q81: Judy is a self-employed musician who performs

Q83: Manley operates a law practice on the

Q95: Bryon operates a consulting business and he

Q99: Todd operates a business using the cash

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents