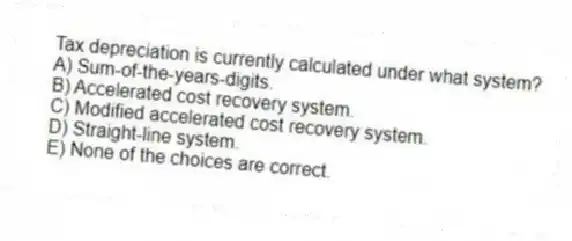

Tax depreciation is currently calculated under what system?

A) Sum-of-the-years-digits.

B) Accelerated cost recovery system.

C) Modified accelerated cost recovery system.

D) Straight-line system.

E) None of the choices are correct.

Correct Answer:

Verified

Q52: Lax, LLC purchased only one asset during

Q53: The MACRS recovery period for automobiles and

Q53: Which depreciation convention is the general rule

Q54: Which of the following depreciation conventions are

Q54: Which of the allowable methods allows the

Q55: Beth's business purchased only one asset during

Q57: Suvi, Inc. purchased two assets during the

Q60: Wheeler LLC purchased two assets during the

Q61: Arlington LLC purchased an automobile for $55,000

Q62: Tom Tom LLC purchased a rental house

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents