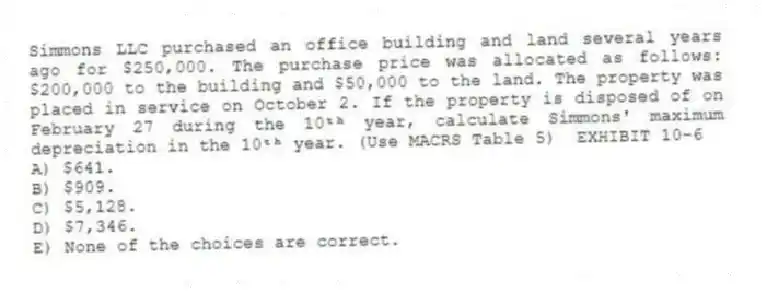

Simmons LLC purchased an office building and land several years ago for $250,000. The purchase price was allocated as follows: $200,000 to the building and $50,000 to the land. The property was placed in service on October 2. If the property is disposed of on February 27 during the 10ᵗʰ year, calculate Simmons' maximum depreciation in the 10ᵗʰ year. (Use MACRS Table 5) EXHIBIT 10-6

A) $641.

B) $909.

C) $5,128.

D) $7,346.

E) None of the choices are correct.

Correct Answer:

Verified

Q66: Racine started a new business in the

Q67: Which of the following assets are eligible

Q68: Daschle LLC completed some research and development

Q69: Bonnie Jo purchased a used camera (5-year

Q70: Jorge purchased a copyright for use in

Q72: Billie Bob purchased a used camera (5-year

Q73: Taylor LLC purchased an automobile for $55,000

Q74: Potomac LLC purchased an automobile for $30,000

Q75: Clay LLC placed in service machinery and

Q76: Santa Fe purchased the rights to extract

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents