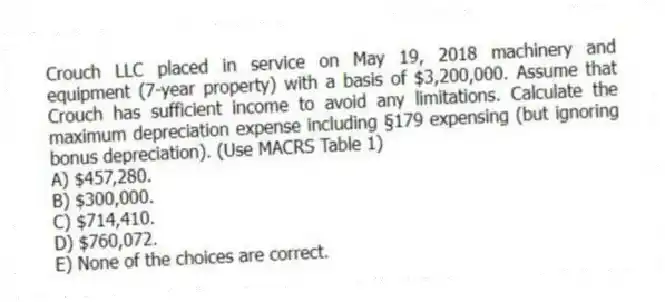

Crouch LLC placed in service on May 19, 2018 machinery and equipment (7-year property) with a basis of $3,200,000. Assume that Crouch has sufficient income to avoid any limitations. Calculate the maximum depreciation expense including §179 expensing (but ignoring bonus depreciation) . (Use MACRS Table 1)

A) $457,280.

B) $300,000.

C) $714,410.

D) $760,072.

E) None of the choices are correct.

Correct Answer:

Verified

Q74: Potomac LLC purchased an automobile for $30,000

Q75: Clay LLC placed in service machinery and

Q76: Santa Fe purchased the rights to extract

Q77: Jasmine started a new business in the

Q78: Gessner LLC patented a process it developed

Q80: Littman LLC placed in service on July

Q81: Flax, LLC purchased only one asset this

Q82: Columbia LLC only purchased one asset this

Q83: Timothy purchased a new computer for his

Q84: Eddie purchased only one asset during the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents