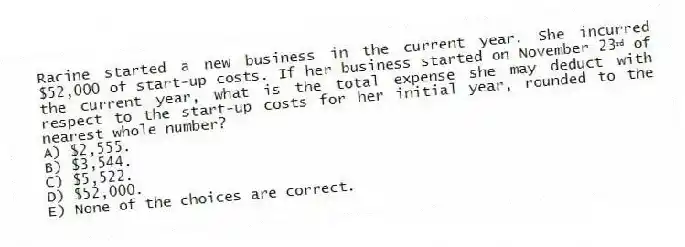

Racine started a new business in the current year. She incurred $52,000 of start-up costs. If her business started on November 23ʳᵈ of the current year, what is the total expense she may deduct with respect to the start-up costs for her initial year, rounded to the nearest whole number?

A) $2,555.

B) $3,544.

C) $5,522.

D) $52,000.

E) None of the choices are correct.

Correct Answer:

Verified

Q61: Arlington LLC purchased an automobile for $55,000

Q62: Assume that Bethany acquires a competitor's assets

Q63: Lenter LLC placed in service on April

Q64: Assume that Brittany acquires a competitor's assets

Q67: Which of the following assets are eligible

Q68: Daschle LLC completed some research and development

Q69: Bonnie Jo purchased a used camera (5-year

Q70: Jorge purchased a copyright for use in

Q71: Simmons LLC purchased an office building and

Q77: Which of the following assets is not

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents