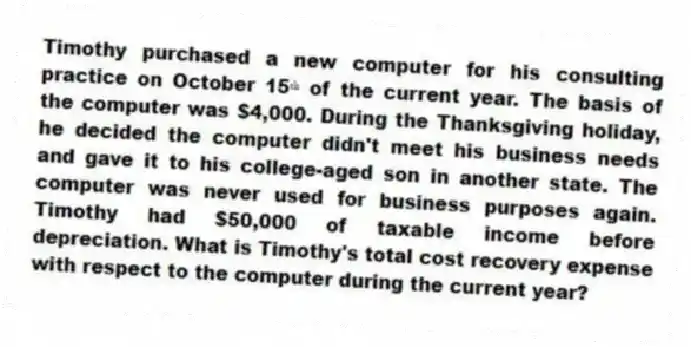

Timothy purchased a new computer for his consulting practice on October 15ᵗʰ of the current year. The basis of the computer was $4,000. During the Thanksgiving holiday, he decided the computer didn't meet his business needs and gave it to his college-aged son in another state. The computer was never used for business purposes again. Timothy had $50,000 of taxable income before depreciation. What is Timothy's total cost recovery expense with respect to the computer during the current year?

Correct Answer:

Verified

No depreciation expense or...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q78: Gessner LLC patented a process it developed

Q79: Crouch LLC placed in service on May

Q80: Littman LLC placed in service on July

Q81: Flax, LLC purchased only one asset this

Q82: Columbia LLC only purchased one asset this

Q84: Eddie purchased only one asset during the

Q85: Kristine sold two assets on March 20th

Q86: Reid acquired two assets in 2018: computer

Q87: Santa Fe purchased the rights to extract

Q88: Jaussi purchased a computer several years ago

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents