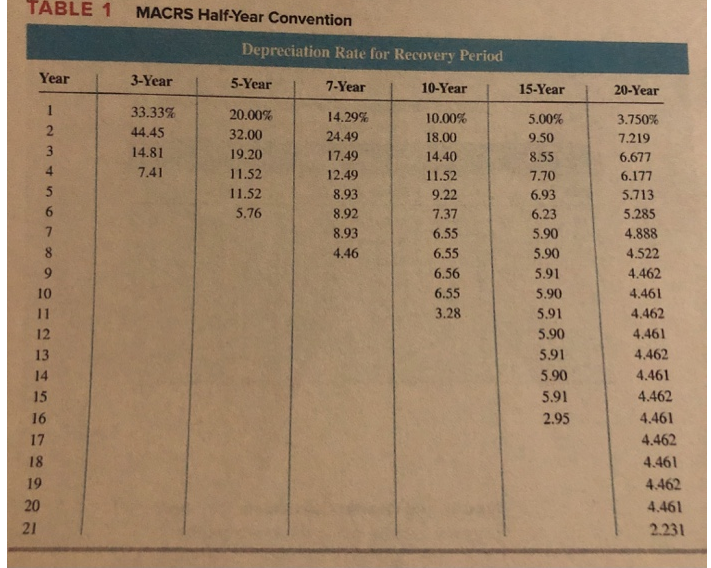

MACRS Table1

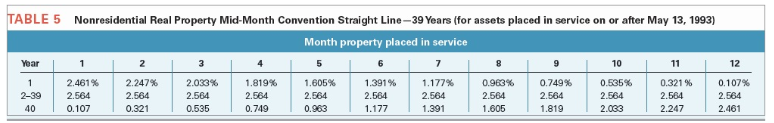

MACRS Table5

Exhibit 10-10 IN THE TEXT

-Boxer LLC has acquired various types of assets recently used 100% in its trade or business.Below is a list of assets acquired during 2017 and 2018:

Boxer did not elect §179 expense and elected out of bonus depreciation in 2017,but would like to take advantage of the §179 expense and bonus depreciation for 2018 (assume that taxable income is sufficient).Calculate Boxer's maximum depreciation expense for 2018.(Use MACRS Table 1,Table 5 and Exhibit 10-10 )(Round final answer to the nearest whole number.)

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q85: Kristine sold two assets on March 20th

Q86: Reid acquired two assets in 2018: computer

Q87: Santa Fe purchased the rights to extract

Q100: Yasmin purchased two assets during the current

Q101: Assume that Cannon LLC acquires a competitor's

Q101: Assume that Yuri acquires a competitor's assets

Q102: Oksana started an LLC on November 2

Q105: Patin Corporation began business on September 23ʳᵈ

Q106: PC Mine purchased a platinum deposit for

Q108: Sequoia purchased the rights to cut timber

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents