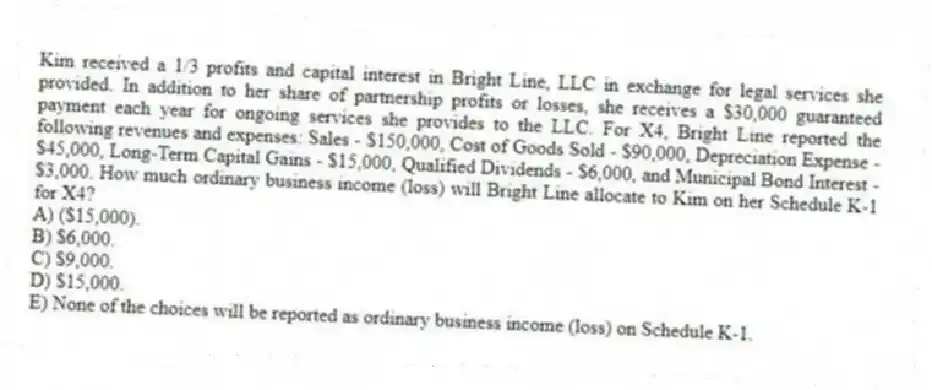

Kim received a 1/3 profits and capital interest in Bright Line, LLC in exchange for legal services she provided. In addition to her share of partnership profits or losses, she receives a $30,000 guaranteed payment each year for ongoing services she provides to the LLC. For X4, Bright Line reported the following revenues and expenses: Sales - $150,000, Cost of Goods Sold - $90,000, Depreciation Expense - $45,000, Long-Term Capital Gains - $15,000, Qualified Dividends - $6,000, and Municipal Bond Interest - $3,000. How much ordinary business income (loss) will Bright Line allocate to Kim on her Schedule K-1 for X4?

A) ($15,000) .

B) $6,000.

C) $9,000.

D) $15,000.

E) None of the choices will be reported as ordinary business income (loss) on Schedule K-1.

Correct Answer:

Verified

Q22: Partnerships may maintain their capital accounts according

Q25: A partner's tax basis or at-risk amount

Q36: Zinc, LP was formed on August 1,

Q37: Sue and Andrew form SA general partnership.

Q38: If a partner participates in partnership activities

Q42: Which of the following does not adjust

Q43: On 12/31/X4, Zoom, LLC reported a $60,000

Q44: Tim, a real estate investor, Ken, a

Q46: This year, HPLC, LLC was formed by

Q54: Under proposed regulations issued by the Treasury

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents