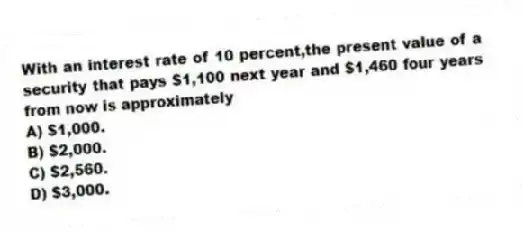

With an interest rate of 10 percent,the present value of a security that pays $1,100 next year and $1,460 four years from now is approximately

A) $1,000.

B) $2,000.

C) $2,560.

D) $3,000.

Correct Answer:

Verified

Q2: A coupon bond pays the owner of

Q3: (I)A discount bond requires the borrower to

Q4: The interest rate that financial economists consider

Q5: A loan that requires the borrower to

Q6: If a $5,000 coupon bond has a

Q8: With an interest rate of 5 percent,the

Q9: (I)A simple loan requires the borrower to

Q10: With an interest rate of 8 percent,the

Q11: Which of the following are true of

Q12: A credit market instrument that pays the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents