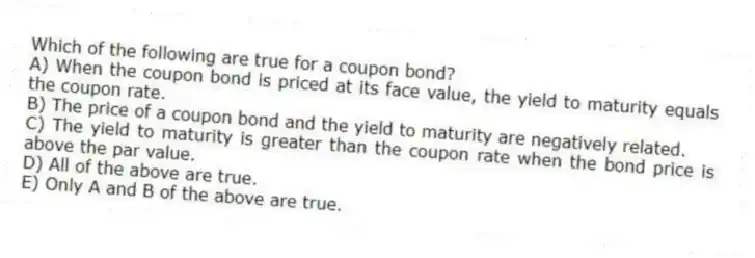

Which of the following are true for a coupon bond?

A) When the coupon bond is priced at its face value, the yield to maturity equals the coupon rate.

B) The price of a coupon bond and the yield to maturity are negatively related.

C) The yield to maturity is greater than the coupon rate when the bond price is above the par value.

D) All of the above are true.

E) Only A and B of the above are true.

Correct Answer:

Verified

Q19: The interest rate that equates the present

Q20: An $8,000 coupon bond with a $400

Q21: A frequently used approximation for the yield

Q22: The yield to maturity on a consol

Q25: If a $10,000 face value discount bond

Q26: Which of the following $1,000 face value

Q27: The yield to maturity for a one-year

Q28: A consol bond is a bond that

A)

Q29: A $10,000,8 percent coupon bond that sells

Q53: Which of the following $1,000 face-value securities

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents