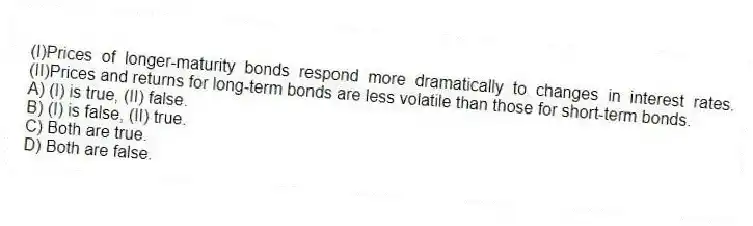

(I) Prices of longer-maturity bonds respond more dramatically to changes in interest rates. (II) Prices and returns for long-term bonds are less volatile than those for short-term bonds.

A) (I) is true, (II) false.

B) (I) is false, (II) true.

C) Both are true.

D) Both are false.

Correct Answer:

Verified

Q46: The return on a 5 percent coupon

Q47: The return on a 10 percent coupon

Q48: If you expect the inflation rate to

Q49: Which of the following are generally true

Q51: The Fisher equation states that

A) the nominal

Q52: In which of the following situations would

Q53: If a $5,000 face-value discount bond maturing

Q54: What is the return on a 5

Q69: Suppose you are holding a 5 percent

Q96: The nominal interest rate minus the expected

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents