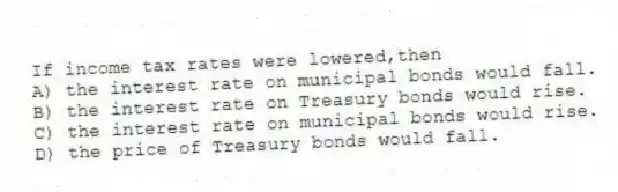

If income tax rates were lowered,then

A) the interest rate on municipal bonds would fall.

B) the interest rate on Treasury bonds would rise.

C) the interest rate on municipal bonds would rise.

D) the price of Treasury bonds would fall.

Correct Answer:

Verified

Q29: When the corporate bond market becomes more

Q30: When a municipal bond is given tax-free

Q31: Which of the following statements are true?

A)

Q32: If income tax rates rise,then

A) the prices

Q33: Yield curves can be classified as

A) upward-sloping.

B)

Q35: If municipal bonds were to lose their

Q36: (I)The risk premium widens as the default

Q37: An increase in marginal tax rates would

Q38: Corporate bonds are not as liquid as

Q39: The Bush tax cut passed in 2001

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents