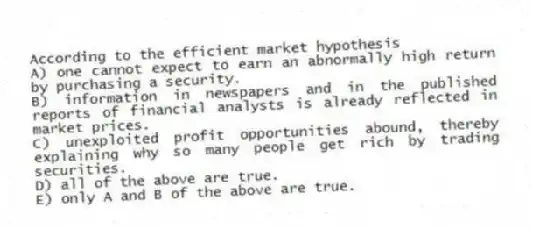

According to the efficient market hypothesis

A) one cannot expect to earn an abnormally high return by purchasing a security.

B) information in newspapers and in the published reports of financial analysts is already reflected in market prices.

C) unexploited profit opportunities abound, thereby explaining why so many people get rich by trading securities.

D) all of the above are true.

E) only A and B of the above are true.

Correct Answer:

Verified

Q5: According to the efficient market hypothesis,the current

Q6: The efficient market hypothesis suggests that

A) investors

Q7: Studies of mutual fund performance indicate that

Q8: The advantage of a "buy and hold

Q9: If the optimal forecast of the return

Q11: A situation in which the price of

Q12: To say that stock prices follow a

Q13: A situation in which the price of

Q14: To say that stock prices follow a

Q15: Raj Rajaratnam,a successful investor in the 2000s

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents